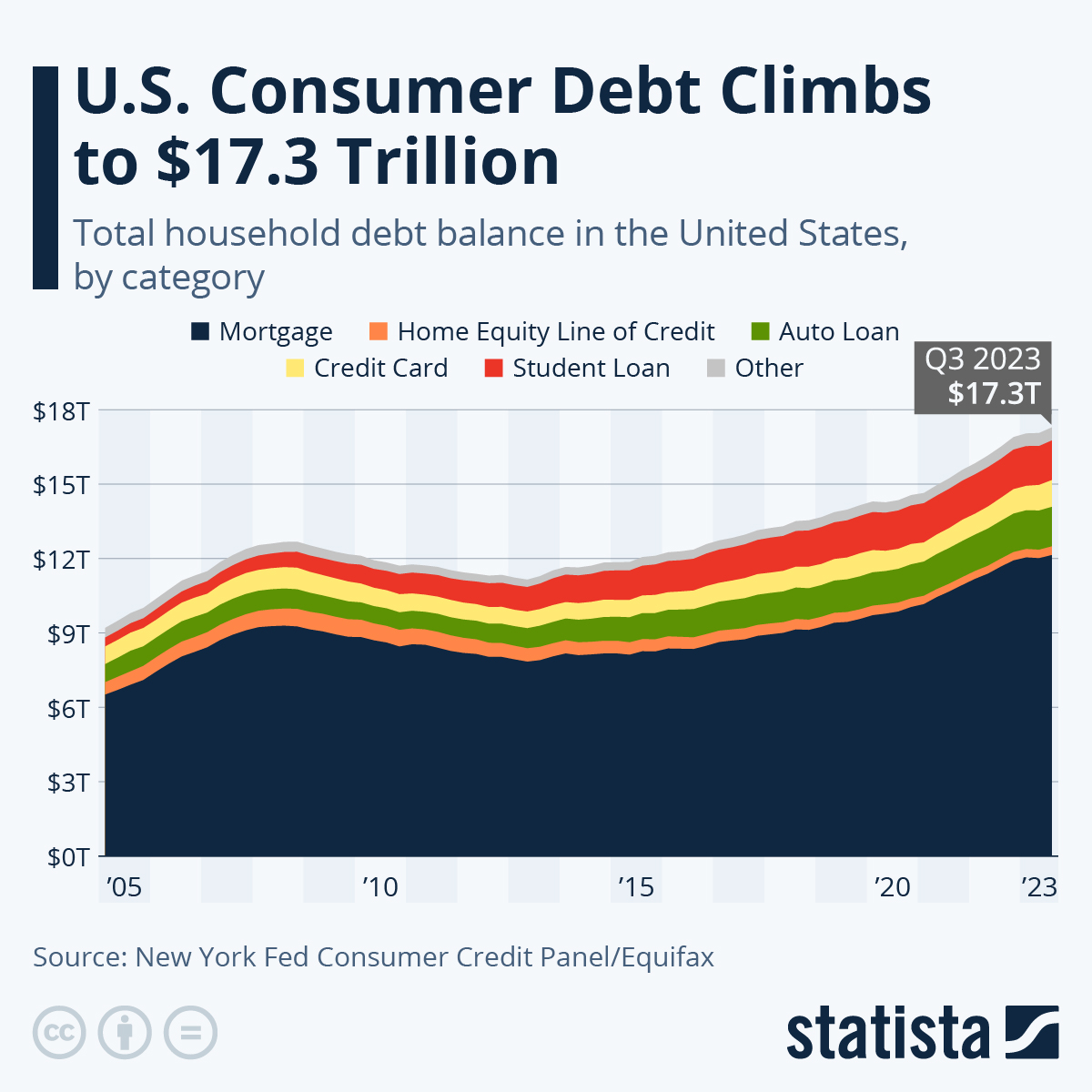

Debt has long been a tool used to buy homes and finance other purchases. Used wisely, it can be an effective way to buy the things you need to build a life and home. However, American households may have gone a bit overboard on borrowing and spending, and are now well over $14 trillion in debt. The vast majority of debt is mortgage loans, but student loans are increasing at an alarming pace.

Even more curious is the debt by education level. Households with college degrees have both the most student loan debt (expected) as well as credit card debt (unexpected).

While debt has its purpose, it also causes stress, reduces needed risk taking, delays marriages and babies, and causes many other issues. A loud voice against debt and the negative consequences of too much debt is Dave Ramsey. He believes we can all live our best lives with zero debt other than a mortgage (and he says pay your mortgage off as soon as you are able).

He outlines a clear plan including 7 baby steps for eliminating debt and building financial peace in his New York Times bestselling book The Total Money Makeover.

I followed Dave’s 7 baby steps (with a little twist – see my journey below) to pay off all of my debt including my mortgage. It has been a truly freeing and eye opening experience. However, as with all big goals, it was not an easy journey. You have to commit to becoming debt free, tolerate your own mess ups, and maintain motivation over the long haul.

The Baby Steps

Before we get into how to stay motivated, if you are unfamiliar with Dave Ramsey, the 7 baby steps are listed below. For those of you who haven’t read The Total Money Makeover, the plan includes (I’m summarizing here) gathering all debt so that you know the full extent of what you owe (e.g. mortgage loans, car loans, student loans, credit cards, personal loans) cutting up all credit cards, and getting on a detailed written monthly budget. Once you have done those things there are 7 baby steps that you follow in order (for the most part):

5 Remarkable Ways to Gain Momentum with Dave Ramsey

It can take many months or years to pay off all debt. So, how do you stay motivated through it all? Speaking from experience, it’s not always easy. I had set backs and bad decisions along the way, but the long term motivation to get the debt payed off despite a mess up here and there is critical.

Dave’s plan has some build in motivation to it, with the biggest being his debt snowball method. This includes listing all non-mortgage debt from smallest to largest. You pay minimum payments on all debts, and put any and all extra money toward the smallest debt.

Once you pay off the smallest debt, you take all the money that was going toward that and put it on the next smallest debt. This allows you to see progress in paying off the small items first and keeps you motivated to keep going.

Note that in addition to your regular salary, he teaches that you should also sell things and pick up extra jobs to get that debt paid down fast.

When I was going through the journey, I needed more motivation when I got to bigger debts that took a longer time. It’s hard to stay motivated over the long term, but here is what I found that worked to keep me motivated:

1. Reward yourself

Find ways to reward yourself for all the hard work and progress you make in paying down debt. Maybe after you pay off the first $5,000, take a day off work to relax or bake yourself some chocolate chip cookies. The trick is to make the reward inexpensive but something to look forward to. For me, this was as simple as having a couple of hours alone to read a good book (for free from the library).

2. Find a community of fellow baby steppers

If you know someone in your personal life who is also working the baby steps, find a way to hold each other accountable and encourage each other. I didn’t know anyone who was doing it at the same time as me, so I joined the The Ramsey Baby Steps Community on Facebook. This allowed me to see other people on the same journey asking questions, sharing issues, and celebrating successes.

Another thing I did was listen to the Dave Ramsey podcast on a regular basis. I loved hearing him answer questions and talk about why this journey is so important. It really kept me on track and was a recurring reminder to keep going.

3. Track it and make it visual

It is important to have a visual reminder of where you are and where you want to be on your debt free journey.

I made my own tracker when paying off the house. It was a simple sheet of paper with rectangles on it. Each rectangle represented a certain amount of debt. My kids helped me color in the rectangles each time a monthly payment or other chunk was paid off. We hung it on the refrigerator as a constant reminder of the goal and all the progress made to date.

There are tons of free and low cost tracker pages on the internet. I’ve also seen people use paper rings looped together in a long line. Each ring represented some amount of debt. As the debt was paid off they would tear off that ring and throw it away.

4. Use affirmations

Affirmations are short sayings that help you re-commit each day to your journey and to encourage you along the way. Write down a few that resonate with you and spend 2 minutes each morning reciting them out loud.

Some examples:

I control my finances because I have a plan.

Being debt free can expand the opportunities in my life.

I am teaching my children how to use money to their advantage and not to fear it.

It is within my power to create a successful financial future.

5. Remember your why

Why did you start this journey? Was it to teach your kids how to manage money and live an abundant life? Was it to reduce your stress and anxiety about debt? Was it to allow you to pursue your dream career without the worry of making a certain salary to pay debt payments?

Whatever your reason, write it down and review it often. Visualize what it will look and feel like to be debt free. Remind yourself that this is all going to be worth it in the end. You didn’t start this journey and do all this hard work just to be in the same place in 5 years.

My Story

I’ve been on this journey too. Like most of us, my story starts with getting into debt.

While my parents were great with money and didn’t have substantial debt, I still learned from an early age that debt is a tool that can be used to get educated, buy a home, buy a car, etc.

It is so very easy – get a credit card, spend the money, and worry about the rest later. When I was a broke college student, it was easy to see the allure of credit cards. I did generally pay them off each month and kept the balances low, but that got the ball rolling.

When I graduated, I went in deeper with car loans, a mortgage loan, and student loans for my MBA program.

After buying and moving into my first house, I realized how expensive it is to buy basics like trash cans, cleaning supplies, and toilet paper. Not to mention furniture pieces, a lawn mower, decorations and paint. I was overwhelmed with all of these purchase on my (very) low first salary.

I quickly became one of the millions of people living pay check to pay check worrying about any unexpected expenses that were not planned for.

Learning about Dave Ramsey

After my husband and I got married, got raises and I got a bigger job, things felt more comfortable and we thought all was well under control, financially speaking. We continued to have the many debt payments and generally lived at the maximum level we could “afford”. At the time, I really felt like a responsible adult because we could pay our credit cards off each month. However, we were by no means financially stable, and if either of us lost our jobs, like so many, we would have been in an incredibly bad place.

When I was in my mid-20s, a co-worker told me about Dave Ramsey and The Total Money Makeover. She mentioned it to me so many times, I finally bought the book. I read it in just a few days, and while I wasn’t ready to dive right in, it really changed my thinking about the role of debt in my life and how I wanted to live.

He advocates very strongly that debt is an anchor and, other than a mortgage, should be avoided at all costs. It caused me to re-evaluate my own financial status, and once I actually added up all my debt I realized I would be in big trouble if I lost my job.

Dave’s plan calls for complete focus on paying off consumer debt in an intense way. He advocates for multiple jobs, selling anything you can, and stopping vacations and any other unnecessary spending.

I didn’t follow Dave’s plan exactly and did not go all-in on intensity as he teaches. However, I did start thinking about debt differently and started making extra payments wherever I could. Whenever my husband or I got extra money, we asked ourselves if we could pay off some debt with it.

Ups and Downs with Debt

Over the next 10 years, we eliminated much of our debt and made extra payments on the mortgage. We did this through substantial career progression, which greatly increased our income. We put bonuses and any other extra money towards paying down debt. However, we also purchased multiple new cars with debt, continued to go on expensive vacations, and bought another new house. Over the last couple of years we increased the intensity and, while still not as focused as Dave recommends, we paid off all debt (including the mortgage) this year.

This took many many sacrifices. When everyone else I knew was taking bigger vacations, making major home upgrades, paying to have their houses cleaned, getting regular mani/pedis, and putting their kids in private schools, I was doing my own nails and my own cleaning (okay – my husband does most of the cleaning) and shoveling money toward paying off the debt. It was hard – I wanted my basement refinished, my outdoor patio upgraded and a new car.

As I write this, I realize how ridiculous it sounds to say it is “hard” not to get a new car, but that is how it felt to me at the time.

The actual payment on the last debt was surprisingly anti-climactic, and it didn’t feel any different at first. But now that it has been a few months, I realize the feeling of having more money coming in than I need each month is very freeing. No one has claim to my money. I haven’t promised it all away so I could own more stuff. I feel more in control of my life and my decisions.

Is it worth it?

It feels like there are so many more options now when planning for the future. What do we want to save for? What is important to us? How can we put our resources to the best use? It is weird, but it opens my mind to so many opportunities, including being generous to others.

Next, we will finish saving for the kid’s college in the next couple of years, do the home improvements we have been wishing for, and take some outrageous trips. But for now, I am just enjoying the benefits and peace of making more money than we need since there are no debt payments to make. The freedom is real and so so worth it.

I believe debt stops many of us from pursuing dreams and doing bigger things that include more risk, but tug at our hearts. It stops us from being as generous as we should be and from taking care of those around us. Who can help others when we can barely pay our own bills?

Want to read more on personal finance, building wealth and investing in income generating assets? Rich Dad Poor Dad is an excellent book to read on your personal finance journey. See 35 incredible Rich Dad Poor Dad Quotes here.